Life Skills: Finance - Budgeting

Budgeting is undoubtedly one of the most useful life skills you will ever learn. Not only is it one of the best ways to keep your finances on track and use to be able to figure out how to get yourself out of a tricky situation, but it also allows you a clear picture of your financial situation and gives you an idea of just how exactly you can plan for the future. Having an accurate budget really is the first step in financial security - it's why every business has a budget.

What is a budget?

A budget is a list of all the money you receive and all the things you spend money on every month. Budgeting helps you see where your money is going, so it’s easier to make sure that you’ve covered all of the things you need to pay for. This also allows you to have a clear idea of how much spare money you have at the end of every month, so if you wanted to start saving you can see exactly how much money that you have left over to save.

Many of us have thought of budgeting before but haven’t gotten around to it. That’s not uncommon, in fact, according to the Money Advice service, 40% of people don’t have any form of a budget. According to them, here are the top reasons why most people don’t do budgets:

- Find it boring (31%)

- Lack of time (19%)

- Lack of confidence in making money-related decisions (11%)

- Prefer not to know (10%)

- Find it difficult (8%)

Now while many of us can relate to one or more of these reasons, budgeting can be the first step to having complete control over your finances and allowing you to start making your money work for you.

How do I start a budget?

Income

You need to figure out how much you earn over a set period - most household budgets usually are based on a monthly period.

Costs

Next, you want to figure out how much you spend in a month and take note of the accurate amounts you pay each month, keep an eye on those pennies! It's important to break up your expenses into priority and non-priority expenses. This is to ensure that you can make payments to all of your priority expenses first as these usually have heavy consequences for not paying on time. For more information on priority and non-priority bills and some ideas on how to organize your bills into a priority order please refer to our bill organization page. Once you have noted all of your costs you can start making your budget.

Making your budget

When you want to make a budget there's a variety of different ways to go about it, if you want to create a budget on excel that is one way, but there are also a multitude of different organisations that all have budget tools to help make it that much easier. These also tend to have a list of the most common expenses so if you have forgotten to check an expense it can be a handy reminder. Moreover, these budgeting tools often will give you insights into your spending habits and let you know if you are spending a lot on a certain expense how you may be able to bring that cost down.

Here's a quick breakdown of the steps on budgeting, and below you will find some budgeting tools we have sourced from a variety of places:

Step 1: Calculate your total income

Add together all the income you get each month. Make sure you include everything, whether it's wages, benefits, or pensions. If some of your income is paid weekly or 4-weekly, you’ll need to turn these figures into calendar monthly ones.

To do this you need to multiply the weekly figure by 52 and then divide this by 12. This will then give you a calendar monthly figure to include in your budget.

Step 2: Make a list of everything you spend each month

Start with your priority bills such as your mortgage, rent, council tax, and utilities like gas, electricity, and water. These are classed as priorities because they have the most severe consequences if your payment is late or if you miss a payment. For more information on priority bills please refer to our bill organisation page.

Next, write down what you usually spend on living costs such as food, clothing, and toiletries. Shopping receipts can help you work out what you typically spend on these items each month. You need to include amounts for things that you only pay for once a year or less often, such as Christmas, car repairs, or vet bills. To do this you need to divide the yearly cost by 12 to give you a monthly figure which you can include in your budget. You can then set this money aside until the bill is due. This is an important step that many people forget to do.

If you’re not sure what you’re spending your money on, try writing down everything you buy over a month. This will give you a clearer idea of your regular spending. Alternatively, if you use online banking and pay for most things through your bank card most banking apps now offers a spending insight service which you can use to see where and how you are spending your money every month.

Step 3: Deduct the total amount you spend each month from your monthly income

If you’ve got any money left over after you’ve paid for everything you have a ‘budget surplus’ or more commonly known as spare money. If you’re spending more money than you’ve got coming in you have a ‘budget deficit’ in which case it's time to start looking at what you can cut back on.

Tools to start creating your budget

Money Saving Expert

Step-change.org's budget planner (more in-depth budget outline)

Money Advice Service's budget planner

What should I do if I have a ‘Budget Deficit’?

If this is what you were scared of, it is not the end of the world. There are steps you can take to try and get yourself back to having more money coming in than you spend. We suggest you speak to a financial advice/guidance service you can find details and ways to contact such services below.

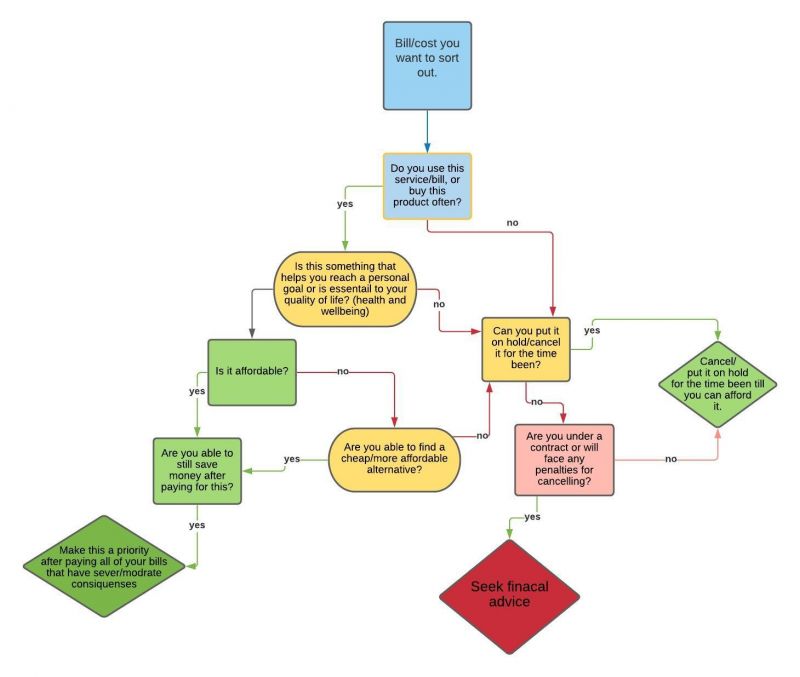

The first of which is trying to figure out what you spend money on that you don’t need such as online subscriptions, takeaways, reducing your shopping bill by having less food waste. If you have breakdown cover, phone insurance, and health insurance, some packaged bank accounts offer all of these services in one usually cheaper bill. Or if you want to cancel a bill it may be worth organising any bills that you may need for your wellbeing. Here's a tool for you to use if you are thinking of cutting bills but are unsure if you find the necessary for your wellbeing.

If you still find yourself in a deficit it might be time to look at your regular bills, such as your internet or gas and electricity. Could you switch provider and get a better deal? A quick comparison site search could save you hundreds of pounds a year. For comparison sites please refer to our reducing your cost page.

Finally, if you find yourself trying to pay off an unaffordable amount of debt, you can always speak to a debt advice service these are free services that have trained professionals who can support you to make a set plan. That is affordable for you to get you out of the red, in a way that genuinely means you are not left having to make hard choices around the rest of your bills.

Note: ECSA is not a financial advice service, and we do not provide financial advice. The purpose of these pages is to give you a brief introduction to some of the information available and provide a basic understanding of the topic. Please use the information in these pages as a starting point to help give you a clear direction for doing your own research.

Financial Services:

https://www.moneyadviceservice.org.uk/en

Phone: 0800 138 7777

WhatsApp: +44 7701 342744

https://www.nationaldebtline.org (over 25)

Phone - 0808 808 4000

Webchat Avilable

Monday to Friday: 9am - 8pm,

Saturday: 9:30am -1pm